Iman van Lelyveld

Welcome to my personal page. I head De Nederlandsche Bank's Data Science Hub and I am a full Professor of Banking and Financial Markets at the Finance department of the Vrije Universiteit Amsterdam were I currently teach Machine Learning for Finance in our honours track Finance and Technology. On this page you will find what I find my most relevant contrbutions in the area of research, data science and teaching.

Data Science

To me, the Data Science approach expands the traditional toolkit. Not just in terms of statistics but also, first, solving the IT issues we face when we want to incorporate the insights we get from analysis into actual policy making and supervision. Or, for instance, the issues that come with the ever growing volume of data. Second, the approach is more about tackling actual problems rather than sometimes rather academic A'-->B' research. For this to work all involved need to learn to speak each other's language. The contrbutions below are thus not just purely Machine Learning applications but also contributions that aim to make any empirical analysis easier and better.

Research

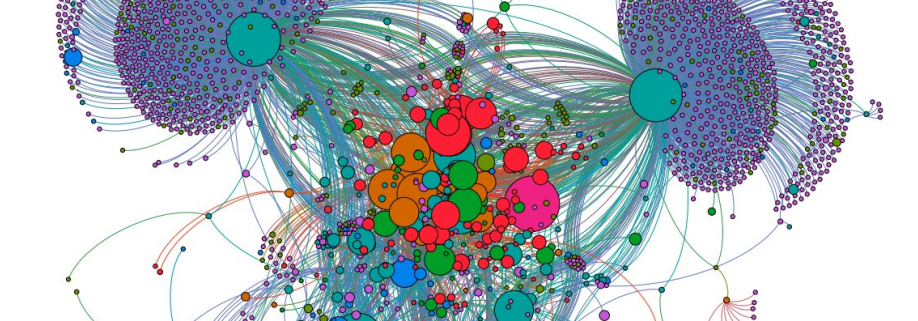

Trying to figure out what makes financial markets work. I am interested in how indvidual agents from networks

and how these networks then affect outcomes such as financial stability and pricing.

Directly to the research page for a more complete overview.

The benefits of international bank have a flip side ...

JMCB (2014)

It pays for pension funds to go it alone and stay the course

JBF (2020)

What does the introduction of the LCR really do?

WP (2020)

Foreign banks were not always a boon in the transition period of CEE countries

JBF (2006)

Teaching

Over the years I've moved from teaching courses on European unification and monetary policy (the topic of my PhD thesis) to a more general course about what was going on in financial markets. Then, in 2019, I have taken a sabbatical that allowed me to develop a course on Machine Learning for Finance. Over the years, I've also taught financial networks on various occasions. This has culminated in an online course for the European University Institute (EUI).

About Me

Source: DNB Analysis (2021) - Estimating Initial Margins: The COVID-19 market stress as an application

Source: DNB Analysis (2021) - Estimating Initial Margins: The COVID-19 market stress as an application

I am always keen to use new data sources for solid data driven policy. At DNB I have been involved in many regulatory

policy

issues covering for instance, interest rate risk in the banking book, deposit guarantee pricing, and CVA charges and

the BCBS Research Task Force. I have published widely on, amongst other topics, interbank networks and internal

capital

markets. I have worked for Deutsche Bank, the Bank of England, and the International Data Hub (IDH) at the Bank for

International Settlements. I joined the Bank of England in September 2008 and experienced the Great Financial Crisis up-close. At the BIS IDH, I was deputy head of a unit tasked with collecting and analysing highly

frequent and granular exposure data of the largest banks in the world.

In the last few years I've been busy with setting up a Data Science Hub (DSH) at De Nederlandsche Bank, the Dutch central bank and prudential supervisor. The DSH is set up as a hub-and-spoke centre of excellence. We do data science projects with all divisions of the bank and we stimulate the data science community through open source lunches, workshops and hackathons. I am very happy to see that the energy in this group is getting traction.